Management Consulting, SAAS, Web Hosting

Management Consulting

Customer Services

Business Consulting

Business Plans/Portfolios

Business Management

Business Registrations

UIF & COIDA Registrations

BIBC & NHBRC Registrations

Bookkeeping Services

Business Bank Accounts

Annual Returns

CIPC Services

E-Mail Management

Proof Reading

Enquire for more...

SAAS

Social Media Management

Blog posting and comments

Forum Management

Website Design and Hosting

Logo Design

Poster Design

Software Development

App Development

Customer Services

Lead Generation

Landing Pages

Enquire for more...

We offer free 15 minute consultations. First time or returning clients do not pay for the first 15 minute consultation with us. Need more detailed advice / information? Book a 1 hour or more consultation for Professional and Executive Assistance from one of our highly qualified consultants.

Blog Posts

HRIH Investments Africa Launches New Website: Empowering Investors in Africa

HRIH Investments Africa has launched a new website to enhance its online presence and provide a seamless experience for investors seeking opportunities in Africa. The website offers a modern and intui... ...more

Services ,Management Consulting

September 24, 2023•2 min read

Introducing the HRIH Investments Digital eBook Shop!

Introducing the HRIH Investments Digital eBook Shop! Browse our curated collection of educational eBooks at <https://ex.hrihinvestments.co.za> and embark on a journey of personal and professional grow... ...more

Services ,Management Consulting

September 24, 2023•2 min read

HRIH Investments - Empowering Your Financial Future

HRIH Investments is here to guide you towards achieving your financial goals with expertise, experience, and a client-centered approach. ...more

Management Consulting

July 03, 2023•6 min read

Digtial Marketing made easy

In this post we speak about Digital Marketing and the immense benefit, however, we also cover some of the myths and pitfalls many fall trap to. ...more

Services

June 25, 2023•3 min read

Website Design and Hosting

In this post we discuss the benefits of websites and best hosting solutions for startups and existing businesses ...more

Services

June 25, 2023•6 min read

Welcome to Our Management Consulting Business

Welcome to Our Management Consulting Business We are a team of experienced management consultants dedicated to helping businesses achieve their full potential. Our services are tailored to meet the u... ...more

Services

June 24, 2023•1 min read

Discover, Stream, and Share Music for Free with HRIH Investments

Are you tired of paying for expensive music streaming services? Look no further than HRIH Investments' music streaming service, available at https://hrihinvestments.profit-vibe.com. ...more

Entertainment

June 22, 2023•1 min read

How to Build Wealth with HRIH Investments

Building wealth is a goal that many of us aspire to achieve, but it can often feel overwhelming or out of reach. Fortunately, with the right investment strategy, anyone can start building wealth and a... ...more

Services

June 21, 2023•2 min read

SMRT16 Blockchain Project

Support your local businesses. Buy them a voucher!

Buy a voucher from us @ https://pay.yoco.com/v/hrihinvestments for yourself or gift a local SME with a voucher to redeem for services or products at our eShop https://ex.hrihinvestments.co.za and help them grow with us.

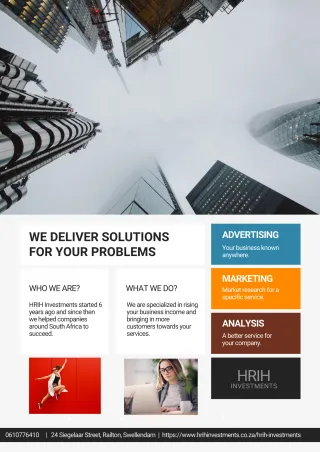

HRIH Investments is a Management Consulting company located in Swellendam, Western Cape, South Africa¹. We have our own website hosting, marketing, digital warehouse with more than 50 thousand products with daily increasing products, including over 8 million PLR products, digital library, NFT collection and SMRT16 crypto project and Funnel Mailer which means that they do not ever pay for email marketing and offer these services to their clients³.

Source: Bing, 2023/06/22

(1) HRIH INVESTMENTS (PTY) LTD Company Profile - Dun & Bradstreet. https://www.dnb.com/business-directory/company-profiles.hrih_investments_%28pty%29_ltd.b2dfd09a19a5e915a02b05766263be7c.html.

(2) HRIH INVESTMENTS - K2015036585 - South Africa - B2BHint. https://b2bhint.com/en/company/za/hrih-investments--K2015036585.

(3) HRIH INVESTMENTS (PTY) LTD Company Profile | Swellendam, South Africa .... https://use.infobelpro.com/southafrica/en/businessdetails/ZA/0764382275.

HRIH Investments is a versatile software company that provides a full suite of management consulting services to help businesses of all sizes thrive. Our team of experienced management consultants works closely with clients to develop tailored strategies that align with their goals and objectives. These include business analysis and planning, process improvement and optimization, and change management and organizational development¹.

In addition to management consulting, HRIH Investments specializes in developing high-performance web applications tailored to clients' specific needs. These applications are designed to improve user experiences, drive conversions, and support business growth. Key features include custom web development, responsive design, scalability, and performance¹.

Source: Bing, 2023/06/22

(1) HRIH Investments: Pioneering Software Solutions for Modern ... - LinkedIn. https://www.linkedin.com/pulse/hrih-investments-pioneering-software-solutions-modern.

(2) HRIH Investments | LinkedIn. https://za.linkedin.com/company/hrih-investments.

(3) HRIH INVESTMENTS (PTY) LTD Company Profile - Dun & Bradstreet. https://www.dnb.com/business-directory/company-profiles.hrih_investments_%28pty%29_ltd.b2dfd09a19a5e915a02b05766263be7c.html.

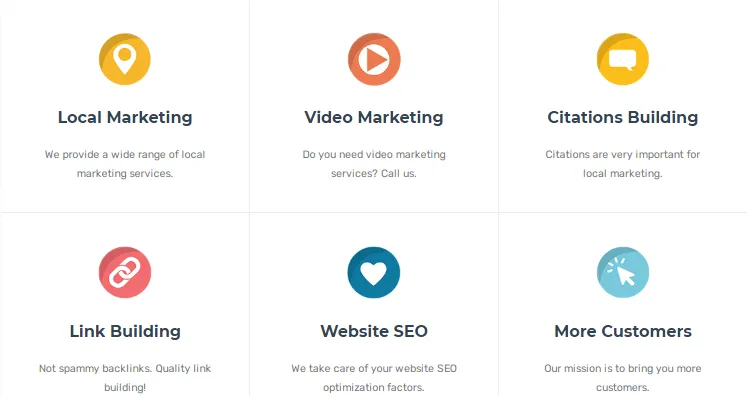

Digital Marketing Services

See the bubble in the right-hand corner of your screen? Just send us a message with your website link, your address (physical and email) and business name, and we will send you a free report on your business performance.

Our detailed report will give you valuable insight on your business ranking as well as how we can help you optimise your ranking online. The better you rank, the more prospective and existing clients you can reach, the better your business will perform. From Landing Pages, to Lead Generation, Social Media marketing and optimisation, we have a skill and plan for you.

With our fully optimised in-house Digital Marketing Agency, we can offer you services and products at affordable prices, you otherwise would pay incredibly high prices for.

We specialize in helping businesses in niche markets grow their online presence and reach their target audience. Our team of experts uses the latest techniques and strategies to create customized marketing plans that are tailored to your unique needs.

We understand that every business is different, and that’s why we take the time to get to know you and your market. Our goal is to help you stand out from the competition and connect with your customers in meaningful ways.

Our services include search engine optimization (SEO), social media marketing, email marketing, content marketing, and more. We use data-driven approaches to ensure that our efforts are effective and deliver results.

Contact us today to learn more about how we can help your business succeed in the digital world.

Unlockable content backed NFTs

We specialize in creating beautiful, functional websites for businesses in niche markets. Our team of designers and developers works closely with you to understand your unique needs and create a website that reflects your brand and helps you connect with your target audience.

In addition to website design, we also offer reliable and secure hosting services. Our hosting plans are tailored to meet the needs of businesses in niche markets, and we use the latest technology to ensure that your website is always up and running.

We understand that your website is an important part of your business, and that’s why we take the time to get it right. Our goal is to help you stand out from the competition and connect with your customers in meaningful ways.

Contact us today to learn more about how we can help your business succeed online.

Take advantage of our Special Offer

SAAS and Web Design/Hosting Presensation

Copyright 2023. HRIH Investments